Can I Put Money Transfer 1099 Misc

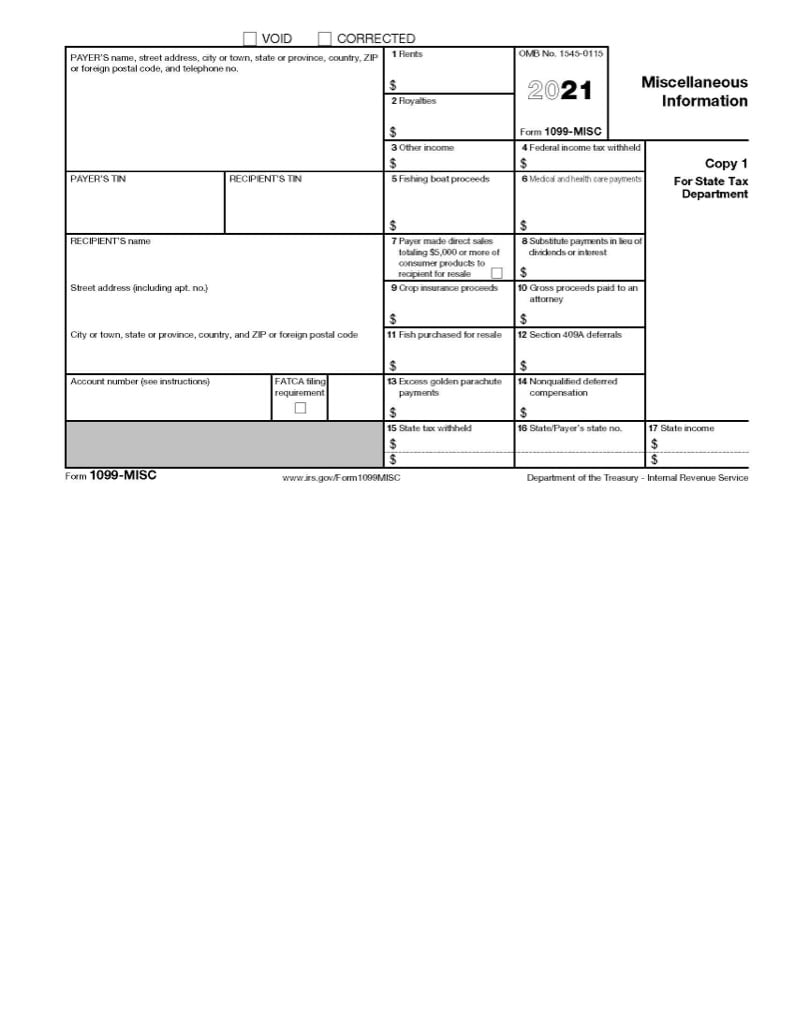

Grade 1099-MISC is used to report various types of miscellaneous income that are not reported on other Forms 1099. Many specific types of income often have their ain forms in the 1099 series, such as the 1099-R for retirement income and 1099-INT for interest.

For tax years catastrophe afterwards Jan 1, 2020, Class NEC, Nonemployee Compensation, replaces Class 1099-MISC for payments to contained contractors, gig workers, and other self-employed taxpayers exceeding $600.

1099-MISC is still used for other miscellaneous types of income such as royalties exceeding $10, payments for prizes and compensation for medical studies and market inquiry. If you received rental income exceeding $600 for the year, such equally renting out your home through a third political party, you may also receive a 1099-MISC reporting the gross rent received.

Should I include a re-create of my Forms 1099 with my tax return?

Generally, unless you have federal or state withholding reported on your Forms 1099, you do not have to include them with your revenue enhancement return.

Do I demand to file 1099-MISC for anyone I paid?

If you operate your own business, you demand to issue 1099-NEC forms to anyone you paid more than $600 for work performed.

Examples of when Form 1099-MISC should be issued include the following payments:

- Attorney fees for professional services of any corporeality

- Royalty payments: $10 or greater

- Whatsoever other payments exceeding $600, such as prize money or rent

While this list is non exhaustive, they are the most common reasons one would demand to send another taxpayer a Course 1099-MISC. The full listing of payments warranting a 1099-MISC tin can be institute on the IRS website.

If yous made payments of a more personal nature, such as consulting an attorney for personal matters or paying for lawn care services, you do not demand to file a 1099-MISC or 1099-NEC.

However, If you regularly pay domestic workers similar housekeepers or nannies, and practise not pay them through an agency responsible for tax reporting, yous may need to register every bit a household employer and pay them with a West-2 and not a 1099-NEC.

Do I owe self-employment tax on all of my 1099-NEC income?

In most cases, if yous are a gig worker, contractor, freelancer, or have other types of cocky-employment income and then yous must include all income, whether on a 1099-NEC or not and pay SE taxes on your net turn a profit.

However, if you receive coin from a source other than a job, such as prize money on a game show or sweepstakes, you are required to report and pay income revenue enhancement on the amount reported on Class 1099-MISC. This income is non considered cocky-employment income, but other income and each blazon has its own rules concerning deductions and how it's reported.

Almost the Author

Jo Willetts, Director of Tax Resources at Jackson Hewitt, has more than than 25 years of experience in the revenue enhancement manufacture. As an Enrolled Agent, Jo has attained the highest level of certification for a tax professional. She began her career at Jackson Hewitt as a Tax Pro, working her fashion up to General Manager of a franchise shop. In her current role, Jo provides skilful knowledge company-wide to ensure that tax information distributed through all Jackson Hewitt channels is current and accurate.

Jackson Hewitt Editorial Policy

Source: https://www.jacksonhewitt.com/tax-help/irs/irs-forms/1099-misc-form/

Posted by: williamslareflot1983.blogspot.com

0 Response to "Can I Put Money Transfer 1099 Misc"

Post a Comment